A guest blog by Christy MacDonald, owner of Clearview Business Services Corp. Christy offers Ask a Bookkeeper sessions at Halifax Central Library.

A guest blog by Christy MacDonald, owner of Clearview Business Services Corp. Christy offers Ask a Bookkeeper sessions at Halifax Central Library.

Quarterly to annual

Recently I met a new business owner who had opened an HST account with quarterly filing. Let’s call her Sarah. Sarah wanted to know how to change her filing frequency to annual so that she only needed to do her books once per year. Nooooo! Say it ain’t so!

But, I get it. I do. No one likes paperwork. It creates deadlines that have repercussions if you miss them, and for anyone outsourcing to a bookkeeper, it costs money. Why wouldn’t someone want less of all of that?

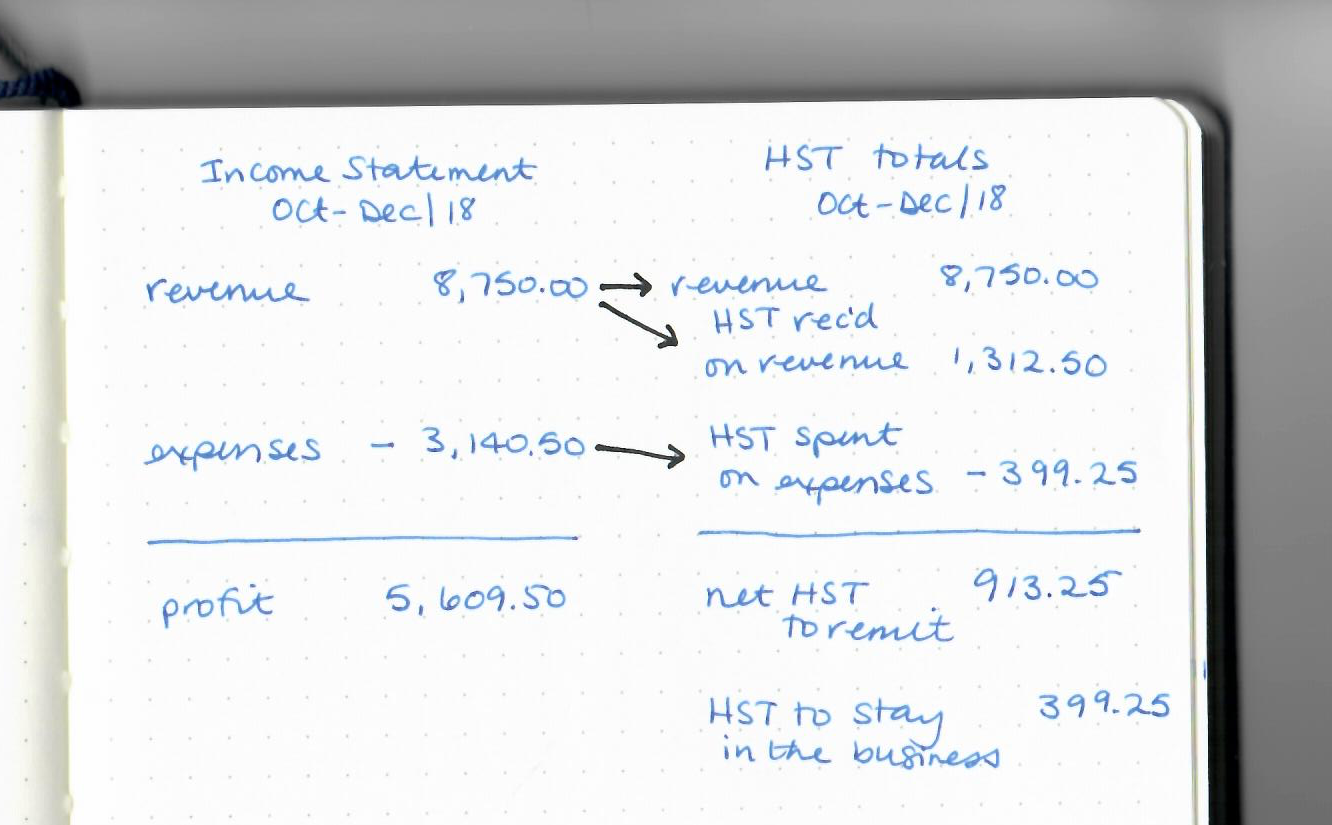

Because! Because sorting through your revenue and expenses to get your HST filing information isn’t the goal. HST is a by-product of a completed income statement—you add your revenue, subtract your expenses, and get your profit. Each piece that contributes to your HST claim also has a place in your income statement. And don’t you want to know your income? And your profit or loss? Just knowing the balance in your business chequing account isn’t enough!

Annual to quarterly

But, what if when you registered for your HST account, you didn’t know that opting into quarterly filing was a choice and you are stuck with annual filing? Don’t worry!

If your HST account’s annual filing is based on the calendar year (and not an alternate fiscal year for a corporation), you can ask the CRA to switch from annual filing to quarterly filing once per year. And that time is now! While you are in the 1st quarter of the new year (January-March), you can request the switch. So while it might have been too late to make the change last year, you can make the change in Q1 2019 and can enjoy quarterly filing for years to come. Like Sarah.

Payroll accounts are the same but the opposite. The default filing frequency is monthly, which is too much of a good thing for most small businesses. If you opt into quarterly filing for payroll, it can line up with your quarterly HST. And they can both be done on the same schedule. Even better!

A word of warning

Think of your HST or payroll accounts as in trays at the CRA where they are expecting to receive paperwork and money from your business. Once these accounts are created, your business will have filing requirements and schedules that must be followed carefully.

When in doubt, quarterly is almost always best. But by all means, do your books monthly if at all possible. And then at the end of each quarter all you need to do is add three months together and you’re done! Then you can look forward to the end of your next quarter so that you can do it all over again. And then you add your four quarters together and your year is done.

Happy New Bookkeeping Year!

Add a comment to: HST Filing Frequencies: Who Cares?